Monterey Financial Services was created in 1989 and began operations in 1990 and although it initially began as a collection agency, it soon added loan servicing and consumer finance with the intent to offer flexible consumer finance options that traditional lenders either cannot or will not deliver. Monterey works with seasoned companies as well as newly launched businesses. Most importantly, Monterey has worked in the vacation club and timeshare industry since inception, fully understands the industry, and offers a finance, loan servicing, and collection program designed to maximize sales and performance.

Monterey employs over 120 talented team players at its 26,000 square foot facility in Oceanside, CA. The executive philosophy, which rolls through management and employees is to treat others with respect and put forth honest, reliable, and dependable services to each of its clients. This philosophy has augmented an environment that promotes long-term, loyal, and experienced support and operations employees that are committed to our clients.

Consumer Financing

Monterey typically purchases consumers that have A, B, and C credit. Credit decisions are not based solely on FICO, although FICO is one of many attributes used to qualify credit. Purchase rates for qualified contracts are separated by credit tier – providing you with a higher payout for better credit. While credit tiers are listed A-C, you have the choice of limiting the bottom credit tier as well as the contract term if you choose.

You will be given access to Monterey’s online instant approval system (OASIS). The system is available 24/7, giving you the freedom to operate outside of Monterey’s business hours if needed. The retail installment contract is generated automatically via email for e-signature. The online approval system is designed to give you an immediate response within a few seconds while displaying the credit tier and associated client payout your customer falls in.

Funding occurs upon receipt of the original signed contract (or confirmation through the OASIS system that the contract has been e-signed) and consumer’s member account has been activated.

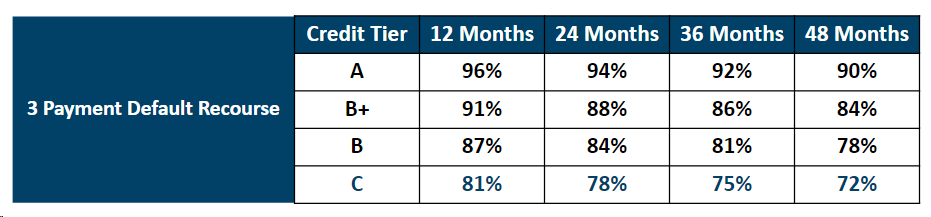

The rates below are using 12, 24, 36, and 48 month terms and assuming a 24.9% APR to the consumer. Rates include a Merchant Owned Reserve of 2%, which can be earned if default rates do not meet or exceed discounted rate. Reserve will be reviewed after 12 months, then every January and July to determine if payout can be provided. All tiers and terms include 6 months Same As Cash at no cost to your business (12 Months Same As Cash if business finances $75,000 or more per month starting their fourth full month).

The structure above is designed to increase sales through an in-house finance program while:

Purchased contracts may be subject to recourse. This means that any contract which is written off with a remaining balance prior three consecutive payments being made must be either replaced with a new qualified contract or repurchased. The repurchase amount is the remaining principal balance times the original purchase rate which means that Monterey DOES NOT earn our discount or fee on accounts that are written off. Recourse clause does not include accounts found to be fraud or contracts merchant cannot fulfill services as agreed.

Monterey will require that a portion of your contracts are placed into the loan servicing program depending on performance to serve as collateral for accounts subject to recourse. As long as you are an active client and you honor your obligation for recourse, you would not see an interruption from the loan servicing proceeds. Percentage of contracts needing to be placed into servicing will be determined by Monterey's Credit Committee.

Loan Servicing

Monterey's professional loan servicing program is designed to manage the entire back end, administrative, accounting, and collection work away for your in-house receivables. Monterey processes monthly payments, sends late notices as needed, and makes as many phone calls as needed when accounts are delinquent. This keeps you from having to manage a portfolio of accounts and keeps your staff free from collection efforts, i.e. you can all focus on sales and customer service.

What does Monterey's Loan Servicing Program Include?

- Unlimited access to our document generation portal with optional credit qualification.

- Welcome letter sent to each consumer at the time the contract is booked.

- ACH and credit card processing for recurring payments or coupon books mailed to consumers.

- Check-by-phone payment processing.

- 24/7 access to Monterey's webs portal for individual account access and accounting and performance reports (see Web Portal for full listing of reports) so clients can track and manage their capital expectations, and insure their portfolio is performing as expected.

- Unlimited inbound/outbound calls through Monterey's call center (all calls recorded and stored).

- Unlimited texting and email campaigns, delinquency notices and correspondence, and Skip Tracing.

- Raw data passed securely for your internal use, if needed, and portfolio performance analysis.

- Monthly ACH disbursements direct to your bank account.

- Optional credit reporting to all 3 credit bureaus. ($200 Set-Up plus $50 Monthly)

Bad Debt Collection

Monterey provides professional third party collection services for delinquent consumer and commercial debt in various industries. By combining cutting edge technology and highly talented collectors, Monterey has augmented the most effective proprietary collection service available in the industry. Additionally, the attention and adherence to Federal and State laws and policies related to debt collection will provide you with the peace of mind that your accounts will represented with full compliance.

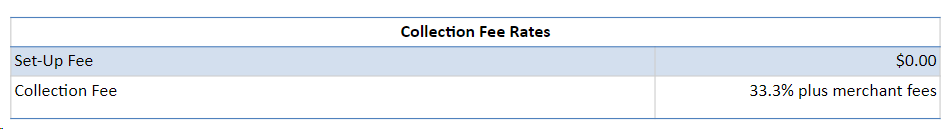

Monterey operates with a risk-free collection pricing structure. The collection fees, listed below, are contingency-based, which means Monterey does not earn fees unless it is able to recover your debt.

Because all Monterey's collection fees are contingent, cancellations are not permitted unless there is evidence that an account was placed erroneously. Should a debtor contact your company for payment arrangements or adjustments after the account has been placed with Monterey, you will be responsible to refer that consumer to Monterey.

All Rates and Terms Will Be Subject to Final Approval by Monterey's Credit Committee