Elective Medical Financing

Finanswr: Your Secret Advantage to Increase Your Revenue.

Cosmetic/Plastic Surgery & Aesthetics Patient Financing

Finanswr: Your Secret Advantage to Increase Your Revenue.

Cosmetic/Plastic Surgery & Aesthetics Patient Financing

Join today and benefit from:

Our mission at Finanswr goes beyond providing access to the best lenders and technology platforms: we are a community of businesses and lenders working together to build a mutually beneficial relationship.

POS Consumer Financing is our specialty, and we will provide you with free coaching and consultation so that you can grow sales as quickly as possible.

With Finanswr, your practice can offer your patients instant financing so they can receive care when they need it.

A strong and effective financing program is no longer a nice-to-have, but a strategic imperative if you plan to grow your Cosmetic Surgery or Medical Aesthetics practice.

Using Finanswr, you’ll discover eager lenders who are able to give you higher approvals and rapid funding. Let’s scale your practice together!

.

It is not uncommon for plastic and cosmetic surgery to cost more than $500 and up to $50,000. Some patients, however, may not have the full amount on hand to pay for their procedures. Patients may instead require plastic surgery financing.

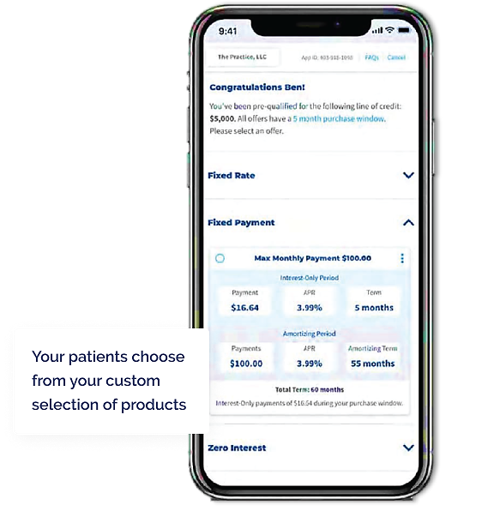

Additionally, providers can assist their patients with point-of-sale solutions. For instance, patients can take advantage of low monthly payments. With this financing option, clients can make smaller monthly payments over a longer period of time to pay for their cosmetic procedures.

With Finanswr, you can easily set up a cloud-based POS financing platform. You do not have to be an accounting major to have the best financing plans in the world

With more than a decade of experience growing revenue numbers for practices, Finanswr is the leading authority on point of sale consumer finance. We help to connect providers with financing partners and lenders that are eager to work with single and multi-practices. As well as Local and Nationwide chains .

Our group of lenders provides your organization with the ability to expand the patient base of your practice by providing low-cost options for them to undergo your procedures when you become a qualifying Finanswr member.

Finanswr helps your practice enroll more patients, even those with challenged credit histories, because we work with a wide array of banks, lenders, and finance companies. As a result, you can expand your practice while providing your patients with easy access to your expertise at low monthly payments they can afford

With Finanswr, patients can get the critical dental care they need at low monthly payments with multiple financing options. Dental practices are paid in full for services rendered, minus applicable fees, and patients receive high-quality care.

A patient interested in the financing program is sent an app on their phone, tablet, or other wi-fi enabled device to complete a digital loan application. Upon submitting the application, the patient receives a number of loan offers from lenders who are interested in providing the patient with the cash needed to receive dental care.

As soon as the lender approves your application, your dental practice is paid in full and the patient receives the care they need. Upon completion of the services, there are no further obligations or responsibilities on your part. You or your dental practice are not responsible for collecting payments due.

By joining Finanswr, you’ll be able to connect your patients with lenders who are ready to help them find the best financing option for their dental needs. In order to make expensive dental care affordable, we have a long list of reliable, dependable financing sources.

When you use Finanswr consumer financing, you have the ability to convert more consultations, faster, and with greater ease, which will benefit both you and your patients. If they don’t have to leave your office to fund their procedure, they’re more likely to commit during their visit, giving them peace of mind and providing you with another patient. Additionally, procedure amounts for small-to-medium-sized practices can increase over 100 percent when low monthly payments are offered. Incremental sales increase and the average order value increases up to 15% in some studies.

It is best for potential customers to visit your site, stay on your site, and have an accurate picture of what you do by including testimonial videos. Videos of customer reviews are effective for many reasons: they provide a personal connection between you and your prospects; potential clients can see themselves in the testimonials and, consequently, under your care; a video shows up-close and from a variety of angles how you can help interested clients achieve similar results, which keeps them on your site longer. The longer a user stays on your site, the more likely they’ll move forward for booking a consultation.

Cooking and workout inspiration aren’t the only things you can find on Instagram. A growing number of cosmetic surgeons are using the platform to market their services. The Instagram platform provides photo and video content-something you should be focusing on for your cosmetic surgery practice-as well as hashtags relevant to your services.

If you are a cosmetic surgery practice and would like to learn more about how offering financing can grow your business feel free to contact us.

In today’s society, cosmetic surgery is not just for the wealthy. You can maximize your advertising ROI by appealing to different demographics with a promotional financing program. Targeting a high-end demographic is no longer enough. Communicate with your client base in a way that speaks to them, which is getting younger and less wealthy than ten years ago.

As a result of our long-term relationships with lenders, we have access to prime, near prime, and subprime lending arrangements. By servicing all types of credit histories, your patients have a greater range of options. It is easier to get approved by lenders with some of the lowest interest rates when you are flexible.

It is important to note that many of these lenders do not determine approvals solely based on credit scores. In addition to employment history, debt-to-income ratio, and loan amount, other factors are taken into account. Credit scores can play a minor role in the overall decision-making process, making approval easier and faster.

Upon approval of a client and funding of the loan, your practice receives payment. That concludes your involvement in the transaction. Payments are made by your patient to the lender on a monthly basis, and if for any reason the patient defaults on the loan, the lender is responsible for collecting the money owed.

.