Home Improvement, Renovation, Air, Water, Solar, and more

Home Improvement professionals are busy, let us make financing as easy as possible for you. Take advantage of our simple and easy financing program designed just for contractors like you. Your cash will be deposited FAST!.

Our mission at Finanswr goes beyond providing access to the best lenders and technology platforms: we are a community of businesses and lenders working together to build a mutually beneficial relationship.

POS Consumer Financing is our specialty, and we will provide you with free coaching and consultation so that you can grow sales as quickly as possible.

With Finanswr, your business can offer your clients instant financing so they can receive the benefits of your products, service and expertise!

Offering a low payment option can result in a 17% increase in incremental sales and a 15% increase in average order value.

Sign Up To Become A Member Of Finanswr

Get Partnered With Enthusiastic Lenders

Start Offering Your Customers, Clients And Patients Low Payments

Effective Financing Programs Equal Increased Revenue

There are times when the biggest challenge home improvement contractors face isn’t the job itself, but rather a customer’s concern about cost. Some may want to upgrade their HVAC system or make other home improvements that can save them money in the long run. However, they do not want to spend the entire sum at once.

Wouldn’t it be helpful if you could offer your customers payment options over a period of time?

Many homeowners lack the savings necessary to make major home improvements, while others prefer to keep their savings padded. Think about offering financing so customers can spread the cost of your service over a longer period of time rather than losing them all at once. The cost of a large repair or equipment replacement is often more expensive than adding a small payment to a homeowner’s monthly budget.

Is it a smart idea for home improvement contractors to offer financing and low monthly payment options to their customers? The short answer is yes. Getting contractor financing can be a win-win for you and your customer: you increase sales, and your customer gets the maintenance and repairs they need at a reasonable monthly cost.

Find out how you can start offering this service to your customers.

If you offer financing, you will have an advantage over other home improvement contractors who do not offer it. In addition, one HVAC leader says customers are more likely to upgrade when they can make monthly payments.

Explore two benefits of offering your customers financing for construction or HVAC projects.

In a recent interview, the CFO of a heating and air conditioning company said his company boosts sales by offering financing based on customer demand.

“Not everyone has $10,000 lying around to spend on a furnace or air conditioner, and financing allows customers to pay for such a large investment over time,” he said. “It’s been extremely beneficial for us and our customers.”

He added that customers who finance are more likely to consider accessories and system add-ons.

“Customers almost feel relieved to be paying $99 a month; they feel their budgets can handle that amount,” he said. “In our experience, once we sell the accessories, upgrades and add-ons, that $99 monthly payment increases to $130 or so, which is still an acceptable amount for homeowners.”

However, many contractors do not offer credit or monthly payments, and that may lower their profit margins.

Some home improvement contractors are fearful that customers will fail to qualify for the terms of a loan, so they simply choose not to offer financing at all.

“I can’t imagine any reason why a contractor shouldn’t offer financing,” “There are plenty of plans out there with low enough costs and dealer fees that everyone should offer it in some form. Sure, there are some fees involved, but in a very short period of time, it’ll pay for itself.”

With Finanswr, your customers can get the upgrades they need and want they need with low monthly payments with multiple financing options. Your business is paid in full for services rendered, minus applicable fees, and patients receive high-quality craftsmanship and products.

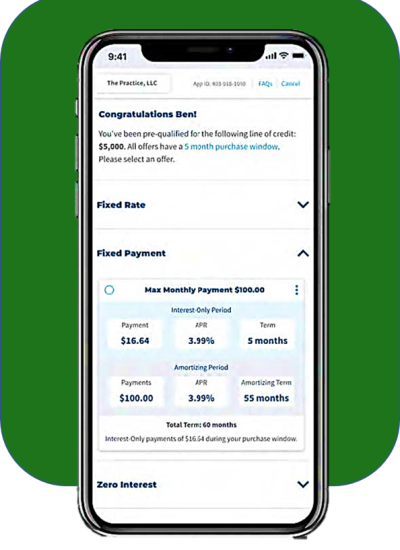

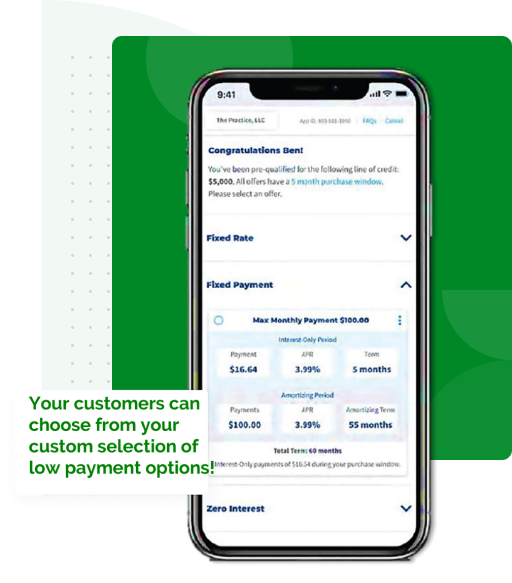

A customer interested in the financing program is sent an app on their phone, tablet, or other wi-fi enabled device to complete a digital loan application. Upon submitting the application, the patient receives a number of loan offers from lenders who are interested in providing the customer with the cash needed to enjoy your work or installation.

As soon as the lender approves your application, your business is paid in full and your customer receives the services you provide. Upon completion of the services, there are no further obligations or responsibilities on your part. You or your business are not responsible for collecting payments due.

By joining Finanswr, you’ll be able to connect your customers with lenders who are ready to help them find the best financing option for their home improvement needs. In order to make expensive upgrades affordable, we have a long list of reliable, dependable financing sources.

There are a few ways to offer these options to your construction or HVAC customers. You can extend credit yourself, which includes checking credit reports and setting up monthly payments. In this situation you take on all the risk in the event a customer stops paying, but you’ll also reap all the rewards, such as interest payments.

Another option is to partner with lenders from financial institutions, which could allow you to offer a mix of options, or use third-party lending. Depending on the company, they may take a percentage as a fee in addition to the risk of default.

Discussing credit scores, monthly payments and interest may be new to you, particularly in the context of your contracting business, but the conversation is worth it. Check out two tips companies learned when they started offering finance to their customers.

During a normal sales call, a residential contractor’s sales manager said his company offers financing on every lead. Over 150 projects are financed by the company every year as a result of this.

The company offers three payment options before it even offers a price: credit card, check, and financing. It is true that 150 projects are a significant number of jobs, but Hall said they represent only 17% of the company’s contracts. This is due to the fact that most customers can pay without financing.

“You don’t want to push financing options too hard, because you don’t want to offend anyone who’s planning to pay cash,”

Each customer’s situation is unique, and so is their preferred payment method. There are some people with plenty of cash in the bank, and there are others who prefer to pay for large-ticket items over time. It can be helpful to let clients customize their options in order to overcome purchase barriers.

As a result of our long-term relationships with lenders, we have access to prime, near prime, and subprime lending arrangements. By servicing all types of credit histories, your patients have a greater range of options. It is easier to get approved by lenders with some of the lowest interest rates when you are flexible.

It is important to note that many of these lenders do not determine approvals solely based on credit scores. In addition to employment history, debt-to-income ratio, and loan amount, other factors are taken into account. Credit scores can play a minor role in the overall decision-making process, making approval easier and faster.

Upon approval of a client and funding of the loan, your practice receives payment. That concludes your involvement in the transaction. Payments are made by your patient to the lender on a monthly basis, and if for any reason the patient defaults on the loan, the lender is responsible for collecting the money owed.

Giving your customers access to financing options can benefit your business and increase customer loyalty. Payment is guaranteed up front, before you start the job, and the client has an easier time paying for the home improvement work they need performed. Any good contractor knows that construction costs can get pretty expensive. A homeowner who wants to add square footage to the property, remodel a room or two, or make necessary repairs to preserve the value of the home may not have the resources readily available to pay for the work in one lump sum. That can impact your business as the customer must wait until he or she can afford to hire you.

But with Finanswr, you nor your customer will need to wait. The work can be done without putting it off because you offer affordable financing options to make it easier for the client to hire you much sooner. You get paid in full, the customer enjoys the benefits of your top-notch construction services with the ability to pay the bill over installments.

Your customers don’t have to wait any longer, they can hire you now. The application process is quick and simple, approvals are fast with a low credit score threshold. If the customer is approved, the funding can be made in as little as one day. Your business isn’t lending the money, your business receives the money. You don’t assume any risk, you just provide the access to a network of lenders who are ready to work with your customers to fund their home improvement projects with you as the contractor hired to do the job.

Home improvement financing with Finanswr links the customer with lenders. We supply you with everything you need to act as that connection between the two, so you can increase your workload and get paid quicker for bigger jobs.

Contractors like you are making the choice to offer financing for customers who need work done on their homes. Making it easier for the client to pay for your services increases the likelihood of being hired to do the work. Financing has become a lot more popular in industries of all sizes and backgrounds because it allows the consumer to pay for the goods and services they need without paying out of pocket in full. More businesses are realizing that when they offer financing to their clientele, their revenues grow as sales increase and new customers turn into repeat customers time and again.

What about your business? Does home improvement financing with Finanswr make sense for you? Consider the following:

How many contractors have lost a job because the client felt the bid was too high? Sound familiar? Part of the reason why prospective clients decide to go with a lower bid or wait months or even years to get the work done is because a large home improvement job is a costly endeavor. Your bid may even be lower than the competition and still the client balks at the price.

It’s all because that cost estimate is a lot of money to spend at one time. Maybe the client doesn’t have it in the budget right now or perhaps they can’t afford to pay the bill in full as one large payment. This is just one reason why you should work with Finanswr. We can give you the ability to convert the client faster and get you started on the job sooner. Best of all, your business is paid up front and the client can pay off the financed amount with flexible terms and affordable payment options.

It’s true. When you offer home improvement financing to your clients, you may soon find yourself charging more because your services are in high demand. When clients review your work online, they can tell others how professional you were, brag about the quality of the work performed, and explain how they were able to pay for the job in easy installments over time. Before you know it, you’ll be increasing your work schedule, bringing in more revenue, and raising your prices to meet demand.

Why not make it so easy for your clients to engage your business? Give them options when it comes to paying for the work they need done. Give them a choice of how to pay for the work. Low monthly installments instead of one or even two large payments before and after the job is complete can also be the deciding factor of whether they hire you to do the work or the business across the street. If your competition is ready to help the customer get access to the financing they need to do the job, you could be losing out on work that could be yours if you offered the same option.

Your business acts as the access point that brings customers and lenders to the table to discuss the financing options that are available. Once the customer applies for financing and receives approval, the loan is funded and that money goes directly to you, the contractor. The lender and the customer have an agreement for the funds to be reimbursed on time. Should the customer default on any payments, the responsibility to reclaim that money falls on the lender not you. Your participation is complete once the home improvement job you’ve been hired to perform is finished. Contact us today to find out how Finanswr can increase your sales and help your business thrive!