Drive revenue with instant credit data, customizable lender LEAD scorecards, and real-time analytics on credit trends

Drive revenue with instant credit data, customizable lender LEAD scorecards, and real-time analytics on credit trends

It starts with a

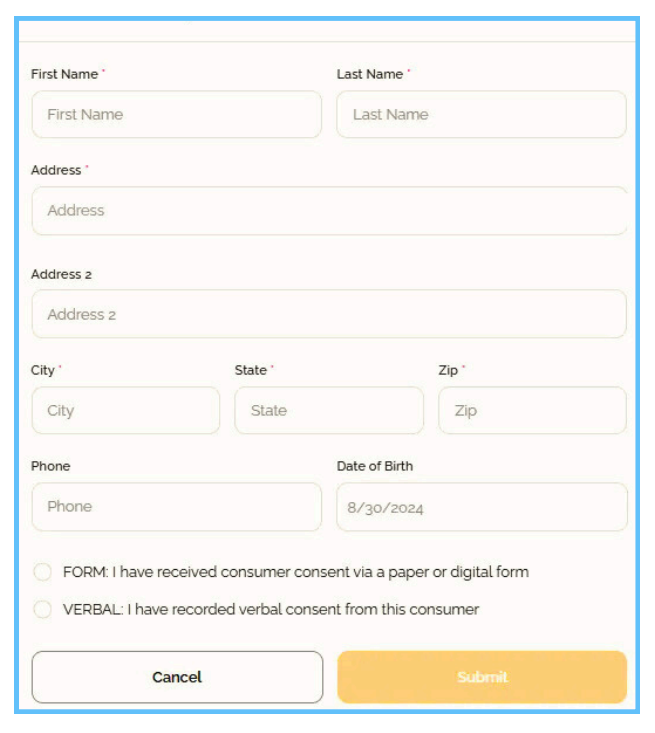

Soft credit pulls do not place a hard inquiry on your customer’s credit report and have no impact on credit score or your lender relationships.

Our platform is most frequently used during the lead generation or appointment confirmation stages where it is unreasonable to ask a prospective customer for their social security number or date of birth.

Instantly View

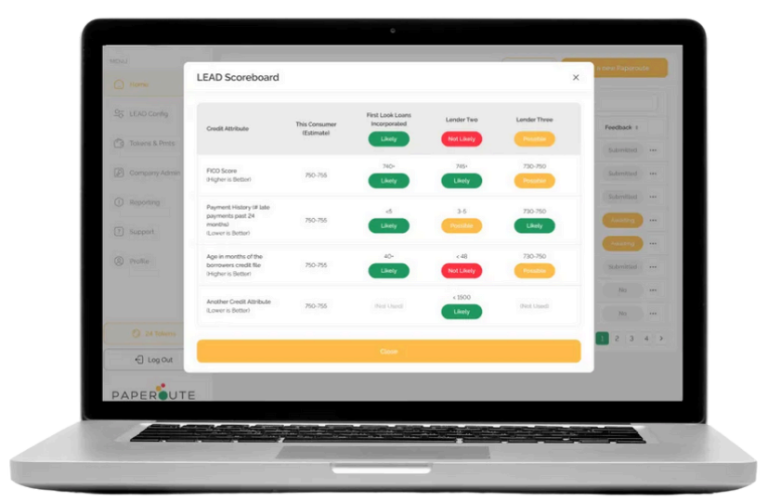

Build a custom LEAD score card for each of

your lenders.

Lender Expected Approval or Denial Score.

Members see 10-12 credit attributes inside our innovative platform, including credit score, that make up a consumer credit profile.

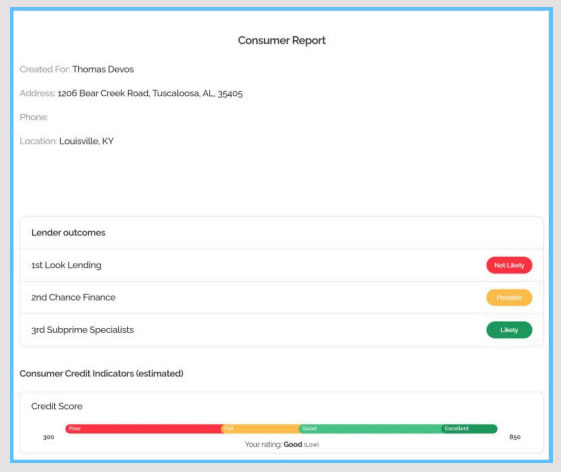

Download a consumer report which includes lender outcomes and any sharable credit attributes chosen by a company admin.

Pro tip: Pro members can determine availability of home equity with our popular bonus attribute, balance on open mortgages and credit cards.

Feedback powers

This great sales tool is powered by member’s feedback to deliver real-time and accurate reporting.

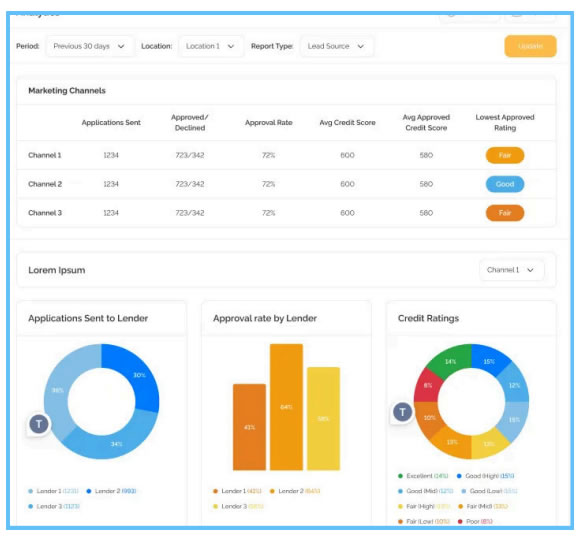

Tailor your marketing message by knowing the credit worthiness of your leads.

Spend time on offers that your customer is likely to qualify for while eliminating those uncomfortable rejections and unnecessary credit inquiries.

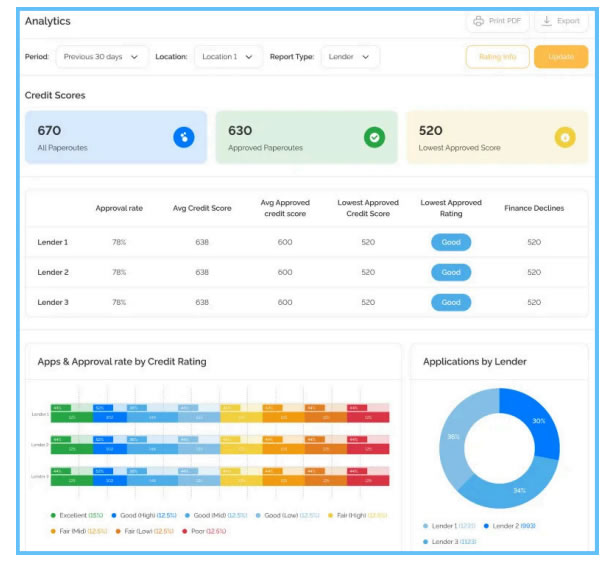

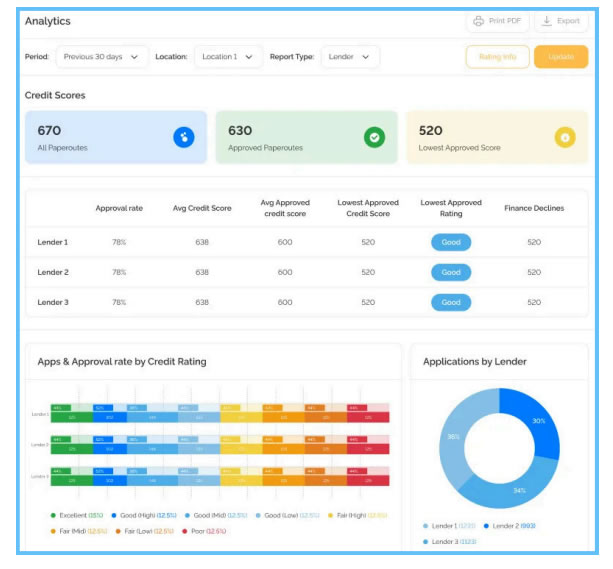

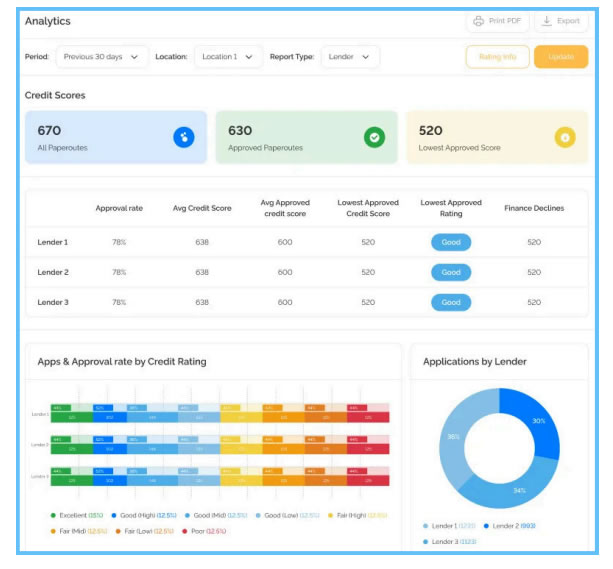

Paperoute delivers reporting on how your 3rd party lenders are performing side-by-side. Your lenders will enjoy an improved portfolio and higher approval rates.

Leads are more precious now than ever before. Data-driven marketing teams look towards our analytics to help determine

the credit quality of 3rd party aggregate lead sources.

Track credit utilization trends, finance declines, and approval rates within your company and by location.

Finance managers rely on our data to determine best lender fit and deliver detailed KPI reporting on lender performance.

Choose which consumer credit

attributes and lender outcomes are to be shared with sales reps to best reflect your company’s sales strategy.